About OpenLP – Enabling Liquidity Solutions for Private Markets.

OpenLP is redefining private market Limited Partner liquidity through its innovative Look-Through Liquidity (LTL) platform. Designed specifically for Limited Partner liquidity and price discovery needs, OpenLP enables LPs to solicit and gage market interest in

1) LP Units – Entire LP Unit, or ‘Stripped NAV’ separated from Capital Call

2) Fractional LP Units, and

- Partial LP Unit

- Vintage, Senior, Junior, Capped, etc

3) Synthetic LP Units

- “Look-through” sale of individual portfolio companies without altering their overall fund commitment.

By creating a transparent and efficient mechanism for price discovery and partial liquidity, OpenLP strengthens the alignment between General Partners and Limited Partners.

As portfolio companies remain private for longer, OpenLP’s technology provides the flexibility LPs need to manage portfolio exposure, enhance liquidity, and optimize returns while preserving their existing rights and obligations around capital calls, recycling, and fees.

Solutions

GP

OpenLP helps General Partners maximize portfolio returns while fulfilling fiduciary duties by enabling LP-to-LP transactions for partial monetization or hedging. This reduces the need to address individual LP preferences on timing and pricing, streamlining operations and protecting overall fund interests.

LP

OpenLP provides Limited Partners (LPs) with greater flexibility by enabling them to anonymously sell or hedge their stakes in private equity, venture capital, and

real estate funds. This benefits LPs, especially those with smaller commitments, by allowing them to accelerate returns or manage risk. The platform also supports LPs in maintaining capital commitments, preserving direct relationships with funds, and fostering ongoing partnerships with General Partners for future investment opportunities.

Asset Managers

OpenLP empowers asset managers with a flexible and unique opportunities to enhance liquidity and fund efficiency. By facilitating fractional LP-to-LP transactions in underlying portfolio holdings, OpenLP allows managers to provide selective liquidity options while maintaining full oversight and compliance at the fund level.

Longer holding periods can compress hurdle rates and delay promote realizations—OpenLP helps mitigate these effects by enabling controlled, partial liquidity events that align with investor needs without disrupting fund strategy.

Example Workflow

Example transaction and execution steps on the OpenLP platform

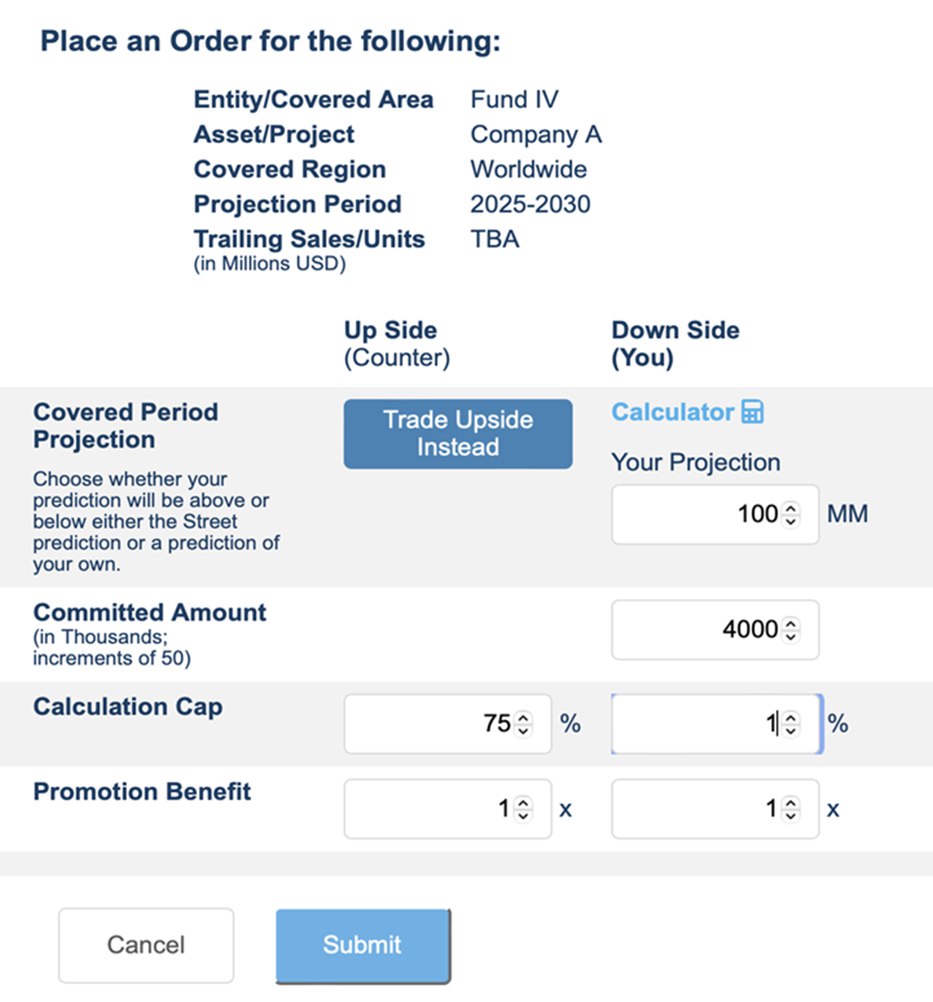

Limited Partner #10 enters a proposed order on the OpenLP platform.

Covered Period : 2025-2030

Portfolio Position : Company A

Strike Price for Buying LP Participation : $100m

Contract Notional Amount : $4m

Cap on Upside Buyer Participation : 75%

Cap on Buyer Down Side (loss participation) : 1%

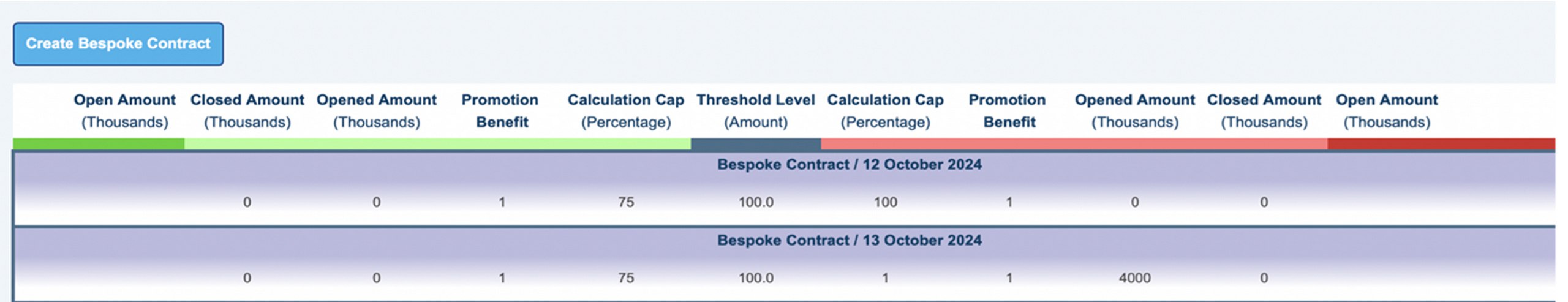

Thus, LP #10 in this hypothetical transaction is placing RFQ in Order Book to sell a 5 year right to receive first 75% appreciation (and Buyer assuming small 1% risk of loss) on 50% of its position above current $100m value of Portfolio Company A position to another LP in Fund (assuming Closed Loop) for a negotiated upfront payment to LP #10

Each Order Book is specific to a given fund and its underlying portfolio company. Once activated, eligible participants are notified and invited to submit bids.Access parameters are defined by the GP or asset manager and may include:

Contact us

Let’s talk

We’re headquartered in New York with an office in Toronto and NJ -ready to serve clients across the U.S. and Canada.